At its Investors Day presentation, Hyundai India announced plans to triple the share of its alternative powertrains by FY2030 under its long-term product and sustainability roadmap. The company aims to expand its portfolio with eight hybrid models, three new CNG vehicles, and three new EVs across multiple segments by the end of the decade.

These launches are part of a broader plan for 26 new products by 2030, including updates and completely new models. Seven of these will be all-new nameplates developed specifically for the Indian market.

- Eco-friendly powertrains to form 53% of sales by FY2030

- 59% of buyers under 40, with strong Gen-Z presence

- Rural markets contribute significantly, driving SUV sales and dealer growth

- Customer loyalty rises to 77%

Eco-friendly powertrains target 53 percent share by FY2030

Hyundai’s hybrids, CNG, EVs to boost SUVs and new segments

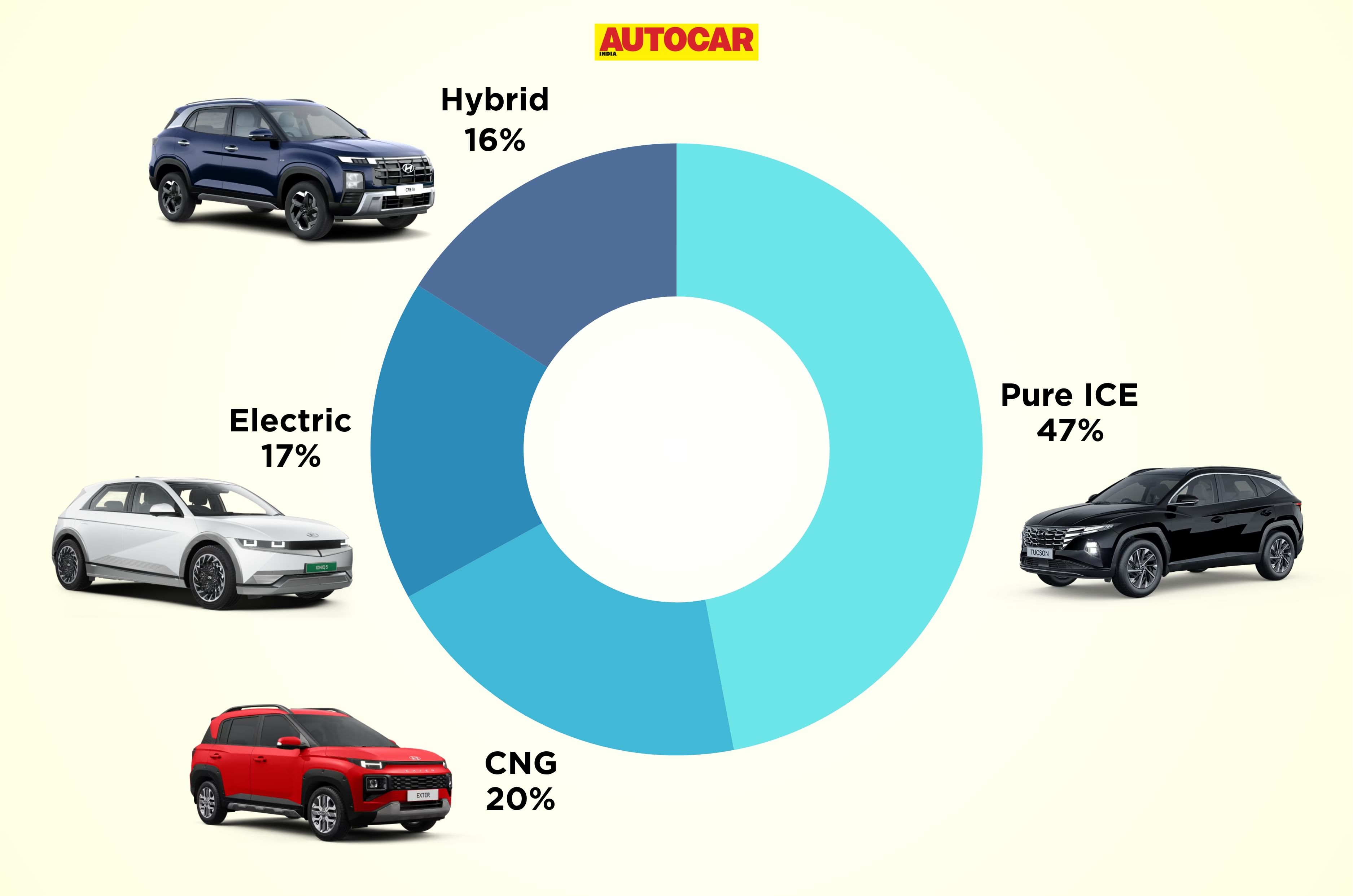

According to HMIL’s projections, eco-friendly powertrains, including CNG, hybrid, and electric vehicles are expected to make up 53 percent of Hyundai’s total sales by FY2030. This marks a significant jump from 3 percent in FY2019 and 14 percent in FY2025. Additionally, the hybrids will expand Hyundai’s SUV lineup and open up new segments.

Petrol and diesel models will continue to account for a large share, but their contribution is projected to fall, from 86 percent in FY 2025 to 47 percent by FY 2030 as Hyundai ramps up its cleaner options.

Young, first-time buyers drive demand for Hyundai

Hyundai attracts growing share of Gen Z and under-40 buyers

Hyundai says its customer base is evolving, with a growing share of young, first-time buyers joining the brand. The company’s internal data shows that 40 percent of its buyers in FY2026 will be purchasing their first Hyundai vehicle, up from 29 percent in FY2022.

59 percent of Hyundai’s buyers are under 40 years old, with 22 percent from Gen-Z, showing a shift toward a younger, more youthful customer base.

Rural markets gain importance

Rural markets drive SUV demand, nearly half of dealer network

Rural India accounts for 23 percent of Hyundai’s total sales and remains an important market for the company. SUVs make up a large part of this rural demand, with 70 percent of rural sales coming from SUV models.

Additionally, rural markets now account for 48 percent of Hyundai’s dealer network, expanding the brand’s reach beyond urban centers.

Loyal buyers keep Hyundai ahead in the Indian market

High customer loyalty reinforces Hyundai’s market position.

Customer loyalty remains strong for Hyundai, with retention improving to 77 percent in 2025, up from 71 percent in 2022.

With more powertrain options and a better understanding of buyer needs, Hyundai aims to strengthen its position in India’s changing car market.

Also see:

Hyundai confirms new MPV, off-road SUV among 7 new nameplates by 2030